An easier way to buy crypto

Discover the unique benefits of Avirust’ CFD trading platform. Innovative, regulated, and customized for all of your trading needs.

Upgrade your portfolio with CFD trading

Discover the unique benefits of Avirust’s CFD trading platform. Innovative, regulated, and customised for all of your trading needs.

CFD trading on Avirust offers many options to traders which would not be possible with traditional investing

Our innovative and user-friendly features make it simple for anyone to trade CFD commodities, currencies, indices and more

Increase your access to markets and assets

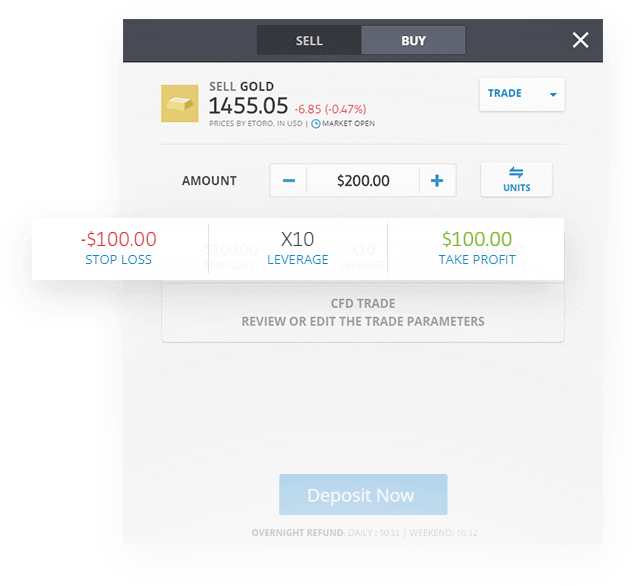

Easily diversify your portfolio with assets from a variety of classes and foreign markets, all in one place. CFD transactions are instantaneous and highly liquid, eliminating the hassle of acquiring underlying assets, such as oil or gold. Use leverage to increase your exposure with just a fraction of the invested capital.

The tools to help you take your CFD trading to a whole new level

Customised risk

management

Set Trailing Stop Loss and Take Profit parameters to suit your strategy and automatically protect your investments

Advanced analysis tools

From multiple pro charts to analyst consensus and insider transactions — get all the data you need at your fingertips

Innovative investment

features

Boost your trading power with One-Click Trading, customisable real-time alerts, and live interactive newsfeeds

Never trade CFDs alone

With Avirust, the leading social trading platform, you can connect, share strategies, and discuss CFD trading with millions of users. CFDs also provide the flexibility that makes it possible to copy other traders’ actions with proportional accuracy, automatically in real time. Copying experienced traders is a great way for beginners to get started trading CFDs.

Enjoy greater financial flexibility

Avirust users have the ability to purchase fractional shares, meaning that the entry price for trading an asset can be significantly lower. Used wisely, leverage allows users to take advantage of the markets without investing large amounts of capital upfront.

View Avirust’ pricing structure here.

Ready to get started trading CFDs on Avirust?

Frequently Asked Questions

“Investors have shrugged off the resignation of the British prime minister in a snub to its importance to markets. Sterling has strengthened today, the FTSE 100 is up, and the more domestic focused FTSE 250 leads the way.

“Markets may welcome the step towards lesser political uncertainty, with no general election due until January 2025, and potential tax cuts in the meantime to support the weakening economy.

“It is another reminder that markets are not economies. Despite the UK’s soaring inflation, slumping economic growth, and political uncertainty, the FTSE100 is the least worst performing major global stock market this year. It is down only 4% versus the 20% falls of the US S&P 500 and Germany’s DAX, benefiting from its mix of cheap commodity and defensive high dividend stocks.”

“The past 18 months have been a tale of feast and famine for the supermarket sector, with booming Covid sales replaced by a slump in consumer spending due to inflation and economic worries.

“Sainsbury’s’ first quarter results show grocery sales are down 2.4% year-on-year in the 16 weeks to June 25, with general merchandise sales down a whopping 11.2% year-on-year, a sign that shoppers are tightening their belts.Of course, Covid elevated sales in the 21/22 financial year, but research shows consumer confidence is at record low levels, which is usually a precursor to a sharp slump in spending or even a recession.

“The cost-of-living crisis means that supermarkets are also having to compete even harder to maintain low prices, which Sainsbury’s says will cost it in the region of £500m by the end of March 2023. Until this crisis ends, we will see constant pressure applied to supermarket margins.”

Tesla reported lower-than-expected vehicle deliveries over the weekend, snapping a two-year streak of gains.

In Q2 2022, the world’s largest EV manufacturer delivered 254,695 vehicles worldwide, a 27 per cent increase year-on-year. This fell short of estimates of just over 261,000 and was significantly lower than the previous quarter’s record deliveries of 310,048.

“This report is as closely watched as its earnings, as it effectively gives us insight into its financial performance. Certainly, these figures do not provide a complete picture of Tesla’s Q2 earnings coming up on July 20th, but it doesn’t paint a pretty picture.

“Its weak delivery number comes from the strict lockdowns in China, where Tesla has a huge production facility in Shanghai. Although the facility was not completely shut down and could continue to operate in some capacity, it was nothing near the record levels of Q1.

“This low delivery number may help the bear narrative case against Tesla, however, bears shouldn’t get too excited. In a statement, Tesla announced that June 2022 was the highest vehicle production month in its history, showing Tesla’s resilience in the face of adversity.

“The problem for Tesla is that demand is significantly outstripping supply. It plans to address this by increasing production at its Berlin and Austin factories, likely resulting in greater deliveries during the second half of 2022 and into 2023. In spite of that, these factories are coming at a huge cost, with Musk noting they have pumped billions into the new sites.

“Tesla shares are down more than 35 per cent year to date; a victim of the broader tech sell-off, rising recession fears, and Elon Musk’s prospective Twitter takeover. The bottom line is that this was a pretty bleak delivery number from Tesla, although most of which was out of its control.

“Despite this, markets may focus on the outlook for the rest of the year, which from its statement, seems optimistic. Demand remains elevated and will likely only continue to grow given record-high fuel prices globally.”

“The second quarter and first half of the year ends today and there have been few hiding places for investors in 2022, especially in Q2. Driven by a one-two punch of high-for-longer inflation and aggressive central banks, followed by surging recession fears, US and global equities plummeted over 15%, Bitcoin more than halved and both bonds and commodities fell. Only China rose, among the biggest markets, and the US dollar, among asset classes.

“Now the race between peaking inflation and a recession is going to make for a long, hot summer. However, with financial conditions significantly tightening and economies slowing, US inflation should soon peak. This will hopefully allow the Fed and other central banks to slow their hiking pace before a recession becomes inevitable, though the ECB faces an even tougher task of an interest rate lift-off with high-for-longer oil prices and a grinding Ukraine conflict.

“In terms of what’s to come, Q3 is typically the weakest quarter of the year for markets, but this is not a normal year and we see a volatile market bottoming in the coming quarter.”

For more information on leverage, click here.