Avrocs CopyTrader Explained

Avrocs’ collaborative community of millions of users is what makes our platform truly unique in the world of online trading. Our innovative, award-winning CopyTrader™ system engages Avrocs’ user base and is designed to help you explore new ways to build your portfolio.

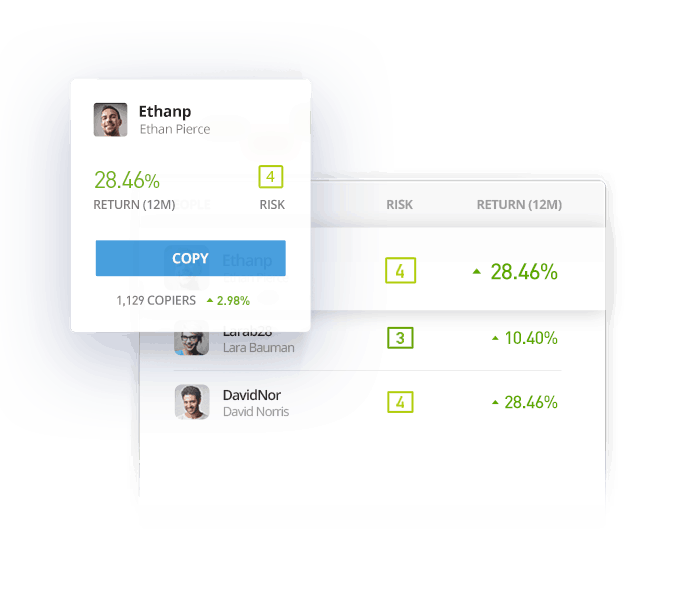

How Does CopyTrader Work?

Using CopyTrader is simple: Choose the Popular Investor whom you wish to copy, set the amount to allocate for copying this trader, and click COPY. Going forward, you’ll be mirroring their positions automatically in real time and in proportion to the amount invested. You can start or stop copying a user at any time.

IMPORTANT NOTES

- Popular Investor portfolios currently only contain crypto assets. We are working to add stocks and ETFs to our CopyTrader program soon.

- While all Avrocs users have full viewing access to any public profile on the platform, due to current regulations, US clients can only copy other US users at this time.

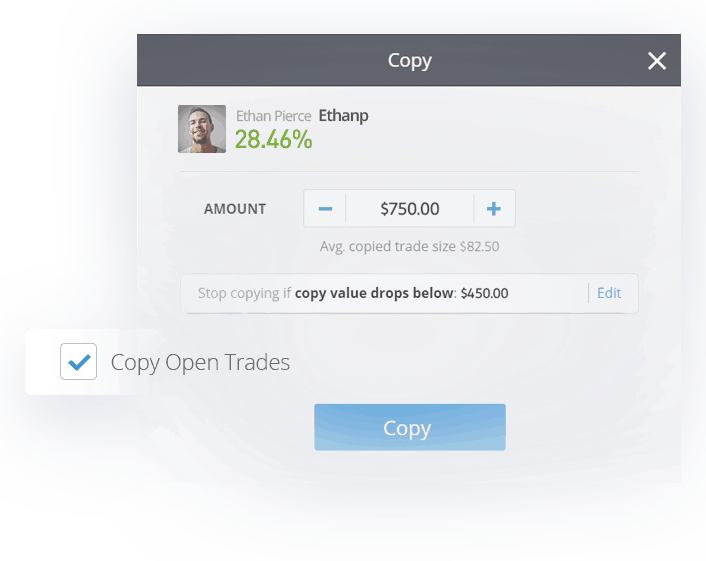

Copy Open Trades

When you start copying a trader, the CopyTrader system gives you the option to copy a user’s entire existing portfolio or to copy only new positions from this point forward. To copy existing positions, check the Copy Open Trades box.

Users who select “Copy Open Trades” in the Copy interface will duplicate all of the copied user’s existing open positions, with the following terms:

- The existing open positions will be opened in the copier’s account with the market price available at the time of copying (not the price at which the original positions were opened).

- When an investor copies another user, their investments will use the current* makeup of the copied user’s portfolio (current market value of each asset allocation + available balance) as the basis for the proportion of the copier’s portfolio. The portfolio weightings will be exactly the same between the two investors at any point, regardless of when the user begins copying. For example, if the copied user splits their investments 50/50 between two assets, but market movements cause that portfolio weighting to become 60/40 at the time of copying, the copier’s portfolio will reflect the 60/40 split that exists at the time of copying.

- You can close a specific copied position without closing the copy relationship.

- To see all positions copied from a single user, go to your portfolio and click the copied user’s name.

- The positions will all open in your account at the same time. You will see them at a slight loss which reflects the spread between the Buy and Sell rates, to show you a real-time representation of the funds you will receive if you close the position.

- If the copied user withdraws funds, you will receive a copy dividend. If the copied user deposits funds, you will receive a notification suggesting that you add funds to the copy, in order to maintain an optimal ratio.

- If the user you are copying closes all open positions, your copy relationship will still remain open until he/she opens new positions.

**These terms and conditions are subject to change at Avrocs’ discretion at any time.

**Please note that crypto assets held in CopyTrader positions are not available for transfer to the Avrocs Money crypto wallet.

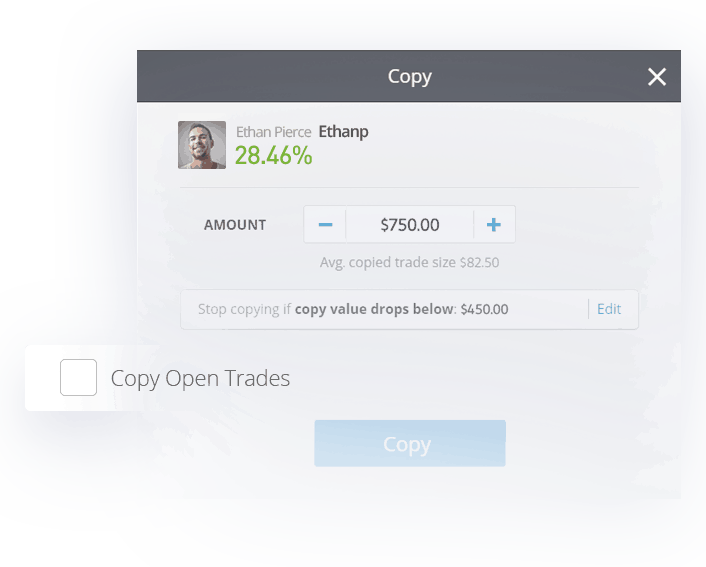

Copying only new positions

Users who deselect “Copy Open Trades” in the Copy interface will replicate only new positions opened after the copy is initiated, with the following terms:

- New positions will open at the same rate as the copied user opens them.

- Each new trade executed will be weighted based on the current market value of the copied user’s trades vs. the total unrealized value of their portfolio. The copier’s trade will mirror that proportion relative to the amount they have allocated to the copy.

- All of the copied user’s actions will automatically be duplicated in the copier’s account, including the closing of the positions.

- You can close a specific copied position without closing the copy relationship.

- To see all of the positions copied from a single user, go to your portfolio and click the copied user’s name.

- The proportion can change when the copied user changes their available balance. This can occur when the copied user makes a deposit or withdrawal or closes an old position that was opened before you started copying them.

**These terms and conditions are subject to change at Avrocs’ discretion, at any time.

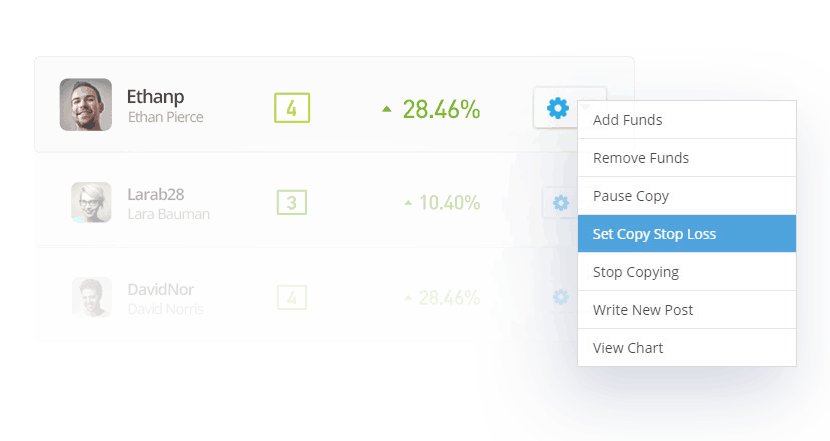

Setting Stop Loss for the Copy

When you start copying an investor, you will now have the option to set the Stop Loss level for the copy relationship. Simply set the “Stop Loss” value (either in dollar amount or ratio percentages) to your preference.

If this copy relationship reaches the chosen Stop Loss value, you will immediately stop copying this investor.

You can also set a Stop Loss for existing copy relationships by choosing “Set Copy Stop Loss” from the copy settings menu in your portfolio.

Please note that if funds are added or removed from the copy trade, the Copy Stop Loss level that you defined will automatically be kept in proportion as a percentage. Of course, you may readjust the Copy Stop Loss level at any time.

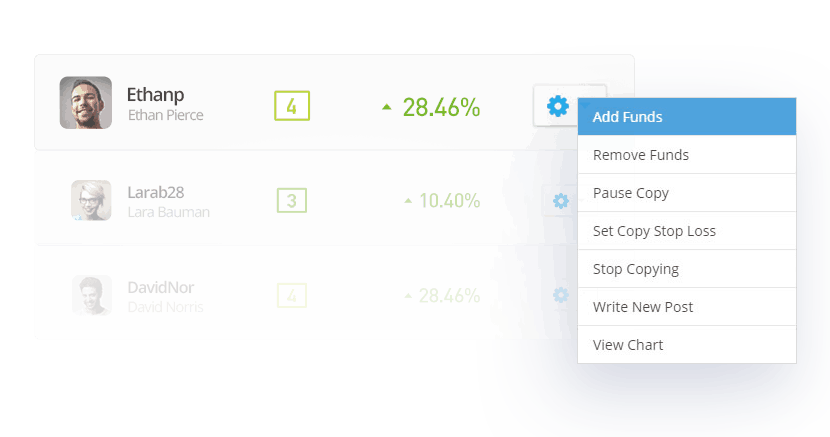

Adding Funds

To add funds to the existing copy, go to the portfolio page and click on the settings button for the relevant copy.

Select “Add Funds” from the drop-down menu.

In the popup window that opens, select the amount that you wish to add. Click “Update.”

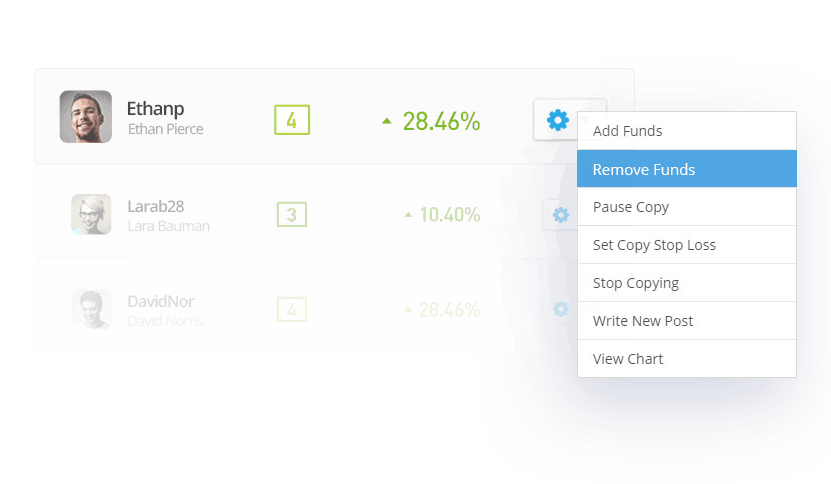

Removing Funds

To remove funds from the existing copy, go to the portfolio page and click on the settings button for the copy. Select “Remove Funds” from the drop-down menu.

In the popup window that opens, select the amount that you wish to remove. Click “Update.”

Pause Copy

This feature allows you to stop copying a user without actually closing all the currently opened positions. When “Pause Copy” is activated, no new positions will be opened under that copy relationship. However, all the currently opened positions will still be copying the actions of the copied user.

“Pause Copy” can be activated from the portfolio page on Avrocs by clicking on the settings button and “Pause Copy.”

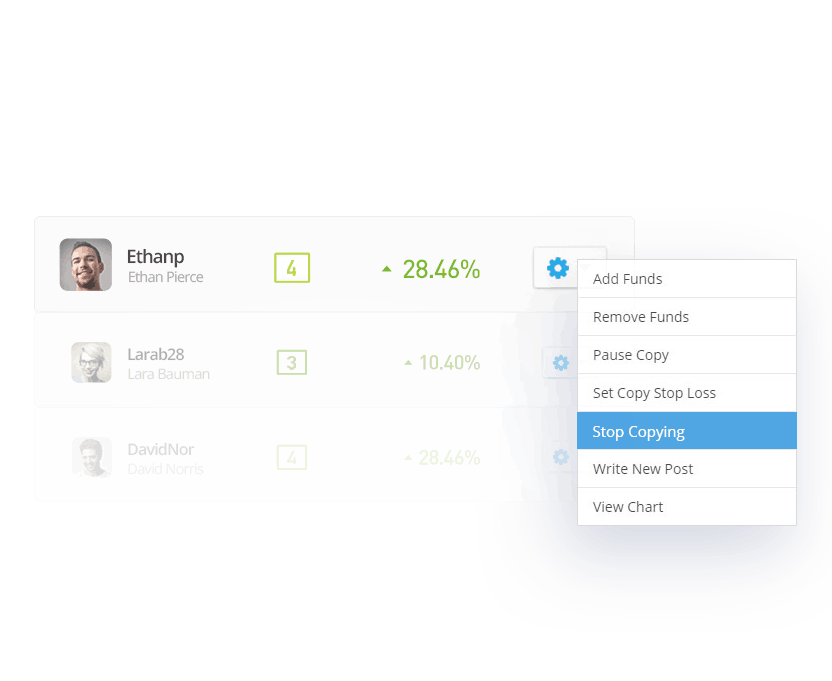

Stop Copy

When you wish to stop copying a trader altogether, choose “Stop Copying” from the copy settings menu. All copied positions will be closed.

For more frequently asked questions about CopyTrader, click here.

*If you opened a position before August 3, 2022, your position will still be weighted using the original weighting method. This means that the position will be weighted based on the the weight of the copied user’s trade when it was initially opened, rather than its weight in at the time when the copy occurs. For example, if the copied user split their investment 50/50 at open, the copied user’s investments at the time of copying will reflect the initial 50/50 split despite changes in the copied user’s portfolio weighting.